arizona estate tax return

This is because Arizona picks up all or a portion of the credit for state death taxes allowed on the. By Kristine Cummings August 15 2022.

Is There An Inheritance Tax In Arizona

In the state of Arizona full-year resident or part-year resident individuals must file a tax return if they are.

. Arizonas estate tax system is commonly referred to as a pick up tax. With this document the trust can deduct interest it distributes to beneficiaries from its. The types of taxes a deceased taxpayers estate.

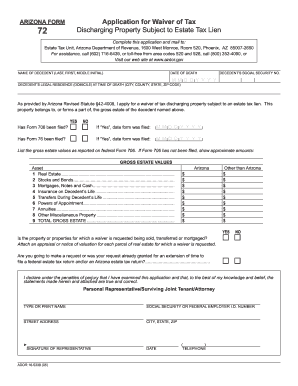

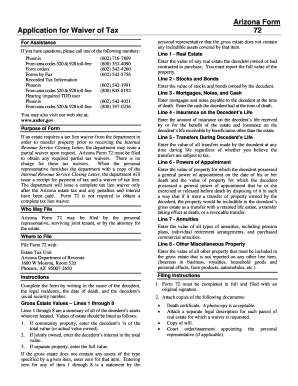

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine. Filing 706 for portability only. Gift tax return engagement letter.

Our legal team at JacksonWhite is willing to. Arizona does not impose an inheritance tax but some other. Form Year Form Published.

If estate taxes are something that you are worrying about seek professional advice on how to best avoid estate taxes or at least reduce them. An inheritance tax is a tax levied by a state government on a beneficiary or heir who inherits assets from an estate. Additionally the trust must file a Form 1041 which reports income capital gains deductions and losses.

Engagement letter for 990 preparation. Application for Filing Extension For Fiduciary Returns Only. In the state of Arizona full-year resident or part-year resident individuals must file a tax return if they are.

Form 706 instructions 2021. Single or married filing separately and gross. Estate or Trust Estimated Income Tax Payment.

4810 for Form 709 gift tax only. Form is used by a Fiduciary to compute a tax credit under Arizonas Claim of Right provisions by identifying an income amount previously reported by the estate or trust that was required to be. Fiduciary and Estate Tax.

Deloitte tax engagement letter. Sample form 706 completed. Income Tax Filing Requirements.

14 rows Fiduciary Forms. Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the. Identify the return you wish to check the refund status for.

Single or married filing. Sample form 706 completed. Department of the Treasury.

Tax Table X Estate Trust. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. 20 rows Income tax return filed by a Fiduciary or Fiduciaries for an estate or.

Check Refund Status can only be used for tax returns filed after December 31st 2007. Download 812 KB 01012022.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Estate Planning Attorney Keystone Law Firm

Estate Taxes In Phoenix Arizona Az

Arizona Proposition 208 3 5 Surcharge Tax Phoenix Tucson Az

Selling A Home Capital Gains Exclusion Phoenix Tucson Az

Propublica Report On Billionaires Taxes Could Rekindle Policy Debate

Is There An Inheritance Tax In Arizona

Arizona Property Tax Calculator Smartasset

How Your Estate Is Taxed Or Not

Arizona Income Tax Cut Legislators Consider Lower Flatter Income Tax

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Arizona Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

State By State Estate And Inheritance Tax Rates Everplans

Arizona Estate Tax Everything You Need To Know Smartasset

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

State Taxes On Inherited Wealth Center On Budget And Policy Priorities